Multiple asset transactions

Asset transactions comprise all the actions you can perform on one or more of your Assets. The following transactions can be performed on an Asset:

Depreciation: The current written down value is reduced by a depreciation amount and the Depreciation year to date for the Asset is increased by the same amount. The amount of depreciation depends on the Depreciation type of the Asset, the Depreciation rate and the number of days for which the Asset is being depreciated. For specific details on the Depreciation transaction, see the Action: Depreciation section of this page.

Revaluation: The Asset’s Depreciation prime cost (and therefore its current written down value) is increased by the revaluation amount, which can be negative and a different amount for both book and tax depreciation schedules. A revaluation allocation account must be specified when this transaction is performed because value is being debited to the Asset account. For specific details on the Revaluation transaction, see the Action: Revaluation section of this page.

Addition: The Asset’s Depreciation prime cost (and therefore its current written down value) is increased by the additional amount which is the same amount for both tax and book depreciation schedules. This transaction is used when something is purchased as an addition to the Asset. Because of this, it is expected that the additional value has already been added to the Asset’s Asset account (through a Payment or a Receive). The Asset account value is not updated by this transaction. For specific details on the Addition transaction, see the Action: Addition section of this page.

Disposal: The Asset’s written down value is set to zero and the Asset’s Asset account and Accumulated depreciation account are both updated to remove the values for this Asset. Finally, the Disposal value debit account is updated to reflect the Disposal value and the Profit / Loss on disposal account is updated to reflect the profit / loss made on disposal. For specific details on the Disposal transaction, see the Action: Disposal section of this page.

Asset transactions can be performed either by:

- Clicking on the Add transaction button on the Asset transactions tab of the Asset form. This will perform the requested asset transaction for the current Asset record

- Clicking on the Perform transactions button in the Multiple asset transactions form

For a detailed process describing how to use this form, please see How to depreciate multiple assets at a time.

Module: Fixed assets

Category: Assets

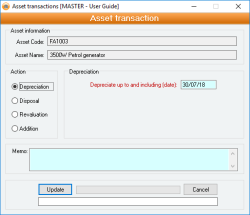

Activation: Main > Fixed assets > Multiple asset transactions > Asset > Add (transaction)

Special actions available for users with Administrator permissions:

- None

Database rules:

- An Asset that has been disposed cannot have any further transactions performed upon it

- You cannot specify a transaction date that is after the current financial year.

- You cannot dispose of more than one Asset at a time

- You cannot revalue more than one Asset at a time

The left-hand side of the Multiple asset transaction form will display a list of selected assets and will show the following data:

- Asset code: This is the identifying Asset code of the asset.

- Name: This is the Asset name of the asset.

- Last Tx date: This is the Last transaction date for the asset - i.e., the last time an addition, revaluation, depreciation, or disposal was processed.

- Select Assets…

- Select the assets you would like to transact. This can range from one to all your assets, there is no limit on the number.

- Perform Transactions…

- When you have selected all the required assets, click the perform transaction button and the Asset Transaction form will pop up. If more than one asset is selected, you will only be able to choose either Depreciation or Addition. Disposal and Revaluation can only be performed on one asset at a time.

- Clear list

- This button will unselect all selected transactions, and will clear the Assets ready for transaction processing list.

Reference: Yes/no

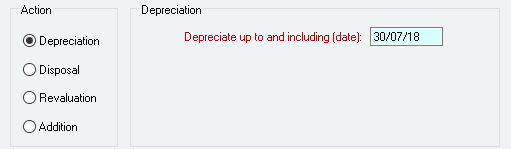

This option selects that you want to perform a depreciation transaction on the selected Asset or Assets for both Book and Tax depreciation schedules. The amount of depreciation of an Asset depends on a number of factors, including the Asset’s Depreciation type.

For a Depreciation type of Prime cost, the amount of depreciation is calculated for each selected Asset and for both Book and tax schedules individually as follows:

- Depreciation Amount = Days For Depreciation / Days Per year * Depreciation rate / 100 * Prime Cost

For a Depreciation type of Diminishing value, the amount of depreciation is calculated as follows:

- Depreciation Amount = Days For Depreciation / Days Per year * Depreciation rate / 100 * Current WDV

For a Depreciation type of Full, the amount of depreciation is calculated as follows:

- Depreciation Amount =Current WVD

In all cases, the following definitions apply:

- Days For Depreciation: The number of days starting from the day after Last transaction date of the Asset up to and including the Depreciate up to and including date on the Asset transaction form.

- Days Per year: The number of days in the current financial year. This takes into account the situation where the current financial year is a Leap year.

- Depreciation rate: The Depreciation rate of the Asset.

- Prime Cost: The Asset’s Depreciation prime cost value.

- Current WDV: The Asset’s current Written down value.

For each Asset, the depreciation amount is added to the Depreciation year to date for the Asset which reduces the Asset’s Written down value. For the Book schedule only, the depreciation amount is credited to the Accumulated depreciation account for the Asset and debited to the Depreciation expense account for the Asset.

Reference: date, mandatory, QuickList

This is the depreciation date used for the Depreciation action. This date cannot specify a date that is outside the current financial year.

Depreciation for the specified Asset or Assets is calculated from the day following the Asset’s Last transaction date up to and including this date. This date becomes the Assets Last transaction date after the transaction has been performed.

Any General ledger transactions that are created as a result of an Asset depreciation use this date as the journal transaction date.

See the Action: Depreciation for more details on how this date is used.

Reference: Yes/no

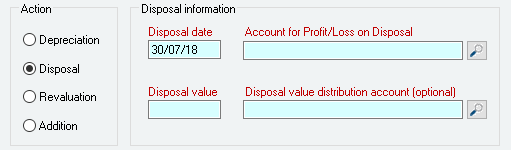

The Disposal action performs a disposal transaction on the selected Asset for both Book and Tax depreciation schedules. A disposal can only be performed for a single Asset at a time. Once an asset is disposed, no further transactions can be performed for that asset unless the disposal transaction is deleted.

When an Asset is disposed:

- The Asset’s at Cost account is credited the Current Written Down Value (Book depreciation schedule).

- The Account for Profit / Loss on Disposal is debited the Current Written Down Value (Book depreciation schedule).

Then, if there is a Disposal value distribution account (optional) entered:

- The Account for Profit / Loss on Disposal is credited the Disposal value.

- The Disposal value distribution account (optional) is debited the Disposal value.

Then, the Current Written Down Value is set to zero for both Book and Tax depreciation schedules.

If there is no Disposal value distribution account (optional) entered, then the Account for Profit / Loss on Disposal will only show a loss. If any income was made from the disposal (e.g. through the asset being sold), then an alternate transaction is needed to account for this (e.g. a Sales invoice posting directly to the Account for Profit / Loss on Disposal account.)

Reference: date, QuickList, mandatory

This is the date used for the Disposal action. This date cannot specify a date that is outside the current financial year and becomes the Assets Last transaction date after the transaction has been performed

Any General ledger transactions that are created as a result of an Asset disposal use this date as the journal transaction date.

See the Action: Disposal for more details on how this date is used.

Reference: account, QuickList, mandatory

This is the General ledger account that is credited with the profit / loss on disposal of an Asset.

When an Asset is disposed, the difference between the Disposal value and the current Written down value of the Asset is the profit or loss that was made on disposal.

See the Action: Disposal for more details on how this account is used.

Reference: currency, mandatory

This is the amount for which the Asset was disposed for a Disposal action. An Asset can be disposed for a greater or lesser amount than its current written down value.

See the Action: Disposal for more details on how this value is used.

This is the General ledger account used to debit the Disposal value for the Disposal action.

See the Action: Disposal for more details on how this account is used.

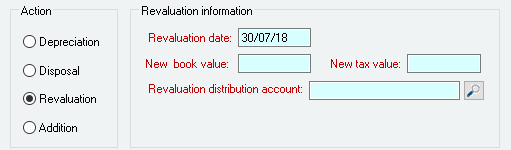

Reference: Yes/no

This option selects that you want to perform a revaluation transaction on the selected Asset for both Book and Tax depreciation schedules. A revaluation cannot be performed on multiple Assets at a time.

A revaluation adds (or subtracts) value to both the book and tax Depreciation prime cost and therefore also to the current Written down value of the Asset). For the Book depreciation schedule, it also performs a General ledger transaction to increase the value of the Asset’s Asset account.

When a revaluation is performed, you must enter the New book value of the Asset, the New tax value of the Asset and a Revaluation distribution account which is credited with the additional value of the Asset.

Reference: date, QuickList, mandatory

This is the date on which the revaluation transaction is performed for an Asset. This date cannot specify a date that is outside the current financial year and becomes the Assets Last transaction date after the transaction has been performed

Any General ledger transactions that are created as a result of an Asset revaluation use this date as the journal transaction date.

See the Action: Revaluation for more details on how this date is used.

Reference: currency, mandatory

This is the book value for a revaluation transaction. It represents the new value you want the Asset to have for its book Depreciation prime cost after the transaction has been performed.

See the Action: Revaluation for more details on how this value is used.

Reference: currency, mandatory

This is the tax value for a revaluation transaction. It represents the new value you want the Asset to have for its tax Depreciation prime cost after the transaction has been performed.

See the Action: Revaluation for more details on how this value is used.

Reference: account, QuickList, mandatory

This is the General ledger account that is credited with the book additional value for a revaluation transaction of an Asset. The book additional value is the New book value less the Asset’s current Written down value.

See the Action: Revaluation for more details on how this account is used.

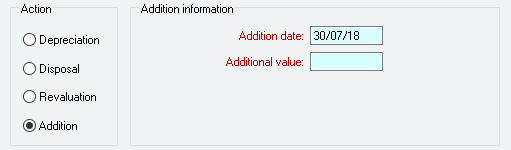

Reference: Yes/no

This option selects that you want to perform an addition transaction on the selected Asset or Assets for both Book and Tax depreciation schedules. An addition occurs when you have already purchased something that is to form a part of an existing Asset. When you perform the addition transaction for the Asset, it is assumed that the value of the addition has already been added to the Asset account for the Asset via the Receive or Payment that relates to the purchase.

The Addition transaction adds the specified Additional value to the Depreciation prime cost of the Asset.

Reference: date, QuickList, mandatory

This is the date on which the addition transaction is performed for an Asset. This date cannot specify a date that is outside the current financial year and becomes the Asset’s Last transaction date after the transaction has been preformed

See the Action: Addition for more details on how this date is used.

Reference: currency, mandatory

This is the additional value that is added on to the Asset’s the book and tax Depreciation prime cost when addition transaction is performed for an Asset.

See the Action: Addition for more details on how this value is used.

Last edit 16/02/24